Key Judgement

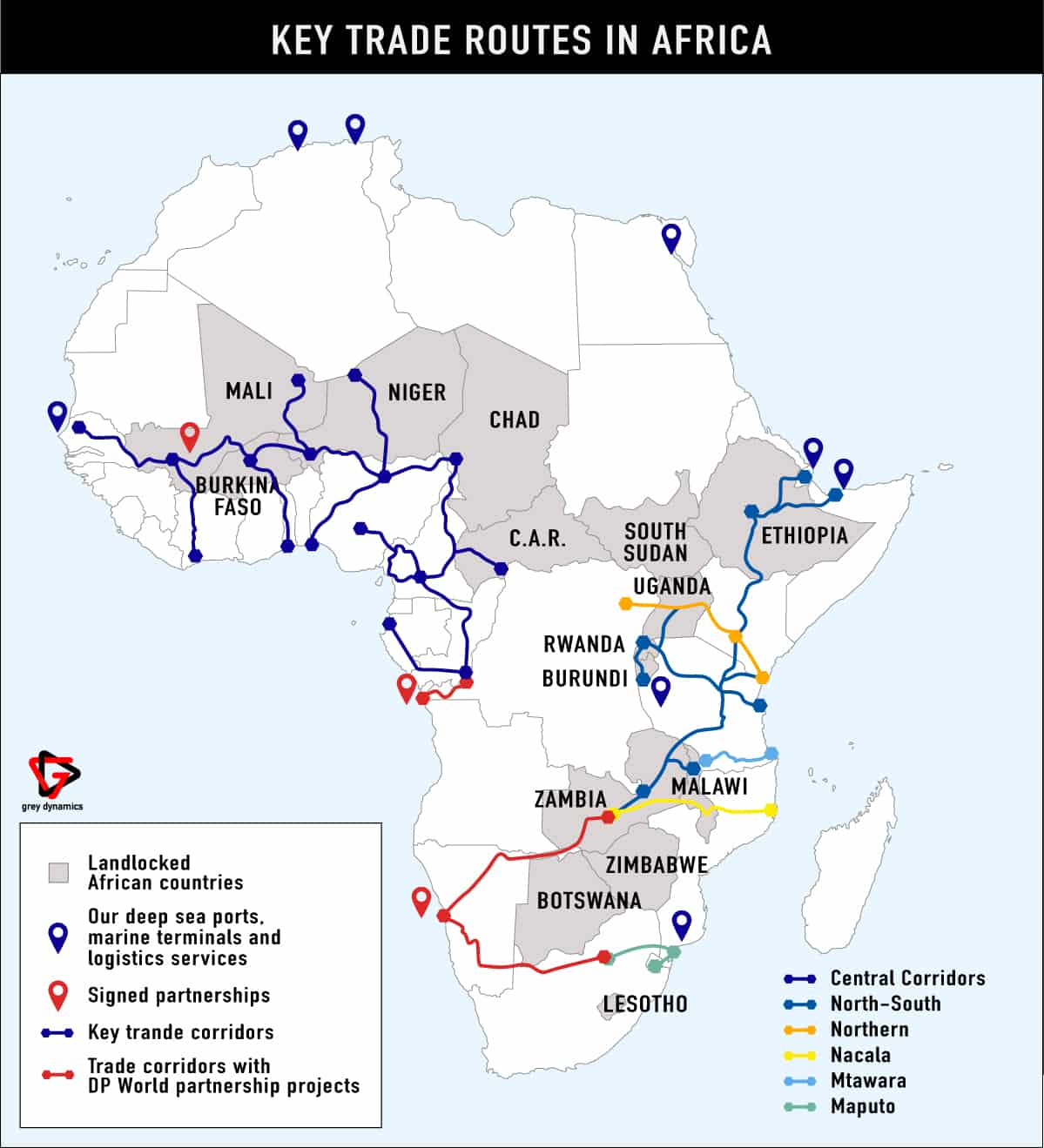

The expansion of DP World supports UAE ambitions of controlling maritime commerce across a vast network. This links the Americas, Africa, Europe, the Middle East, and Asia. Military expansion near the Gulf is to secure these interests, as well as consolidate power in neighbouring Yemen. The UAE faces competition in developing African network and infrastructure projects, despite having a significant foothold.

- DP World is establishing a $1.1 billion, 1-500-acre deep water port in Ndayane, Senegal (near Dakar). In Angola, DP World is negotiating to operate the Multi-Purpose Terminal (MPT) at the Port of Luanda.

- State-owned DP World lost control of the Dolareh Containment Terminal in Djibouti in 2018. A 51% stake in the neighbouring Port of Berbera in Somaliland, facilitates Emirati influence in East African geopolitics and commerce. The Senegal/Angola expansion will facilitate the UAE in North, West, and South African commerce.

- The UAE aims to expand their military foothold, in partnership with Saudi Arabia. This is based on the expansion of military installations in the Horn of Africa. Controlling Red Sea and Bab el-Mandeb strait commerce and logistics is a strategic objective, Comoros is an extension of interest in the region.

Project Senegal

Senegalese expansion is a similar project to DP World’s $1.2 billion Posorja port in Ecuador, establishing a special economic zone adjacent. The objective is creating a ‘mega-port’, able to accommodate the world’s largest container ships. This project will highly likely establish a major logistical hub, while serving as a gateway to West and Northwest Africa. The free trade zone is likely to attract foreign capital seeking tax exemptions. The project is the single largest African DP World investment, reflecting strategic intent to increase involvement in trade corridors within the continent. Dakar is a highly favoured port for Atlantic south-bound trade from Europe, complimenting existing DP World networks in Africa and beyond. These hubs will highly likely witness an increase in commerce. The emphasis on infrastructure development now is crucial, as blockchain and automation will likely be integral parts of global end-to-end supply chains.

DP World is delisted from the stock exchange, becoming fully government owned. UAE bilateral agreements will create significant income for Senegal. Based on this, there is a realistic probability that the UAE may establish a military presence. The US seeks to reduce its footprint in the Middle East and Africa, an Emirati official stated: “Fill space, before others do”. There is currently a scramble in Africa for influence. The UAE and Saudi Arabia compete with other geopolitical strategies from Turkey /Qatar and Russia, while facing an economic powerhouse threat from China. However, the Horn of Africa is almost certainly most important for the UAE, due to the strategic location.

The Horn

The main economic challenge to the UAE strategy in Africa is a similar Chinese vision (Belt & Road initiative). Strategically, significant challenges are posed from Turkey and Qatar, especially in the Horn of Africa. The UAE lost a strategic foothold in Djibouti, losing control of the terminal to China Merchants Port Holdings (CMP). Attempting to use the port as a military launchpad into adjacent Yemen, UAE further damaged deteriorating relations with Djibouti in 2015. An Emirati base in Assab, Eritrea became a replacement for military operations. This allows the UAE and Saudi Arabia to project military power along the crucial Bab el-Mandeb strait. UAE intent to pressure Somalia to cut ties with Qatar in 2017 after an embargo was imposed. Turkish and Qatari influence proved to be prevalent, leading to Emirati re-focus on Somalian federal states.

A trade corridor from Dakar into central Africa is crucial, with an adjacent corridor from the Horn of Africa. Over 10% of global international trade travels through the Red Sea. A $442 million DP World investment in the port of Berbera in Somaliland reflects this. The objective is to be the dominant economic, political, and military force in the region. The UAE base in Bosaso, Somalia’s Puntland state, supports this assessment. The UN Security Council opposed this, coinciding with an outcry from Somalia’s federal government. The strategic expansion is not only for economic reasons, as Gulf rivalry is exported to the African continent.

Comoros

On the 25th November 2020, the UAE and Comoros signed a Memorandum of Understanding (MoU). The MoU focuses on military and defence cooperation between the two countries, which already collaborate in other fields. The Abu Dhabi Fund for Development already funds various Comorian government development projects. In January 2018, the Comorian government admitted 52,000 citizenships had been sold to foreigners, mainly from the UAE. Comoros is a country struggling with poverty and human development.

This situation places the UAE in a position to improve bilateral relations with ease through investment. The UAE is already the leading exporter to the Islands. Comoros is located opposite the East African coast, and the Indian Ocean. The small archipelago does not have the infrastructure to become one of DP World’s main logistical hubs. This does not mean it cannot become a key point of commerce. The islands are opposite Mozambique’s $20bn Liquefied Natural Gas Project. This could create an energy ‘stop off’ for Middle Eastern and Asian markets once fully operational. The islands can still be utilised for various logistical operations, and in the future, the military agreement may create a new launchpad for UAE ambitions.

Image: CGTN Africa (link)